FROM VISION TO EXECUTION: LEADING IMPACT MANAGEMENT

An interview with Tobias Temmen, Banker for sustainability, VC, and Solarpunk, co-founder of The Gardens

A change in purpose changes a system profoundly, even if every element and interconnection remain the same,

with his background in some of the key actors in the innovation ecosystem, Tobias tailors his daily actions to deliver practical perspectives on how thinking in systems is critical when reconsidering our incubation models.

From the assumption that we seek to better support inclusive and impact-driven ventures to make an impact in our societies, we should reconsider our incubation models and entrepreneurial ecosystems we operate in. It is not about restarting from scratch, but rather re-thinking our strategies, partnerships and institutions to be more inclusive, sustainable and impact-oriented.

EBN: Vision at the start of each journey characterises your approach to sustainability, human impact and climate change. Why would you stress this kind of thinking with the ultimate result in mind?

Tobias: Your vision determines your strategy – and both, in combination, are guiding your day-to-day operations and strategic decision-making. Thinking about your venture building from the result – with true impact in mind – boosts your efforts.

EBN: Where do venture building and venture capital operating models converge? And what can we learn from the many moments that they diverge from each other?

Tobias: As a venture capital firm, you provide financial resources to build and scale a venture – sometimes augmented by hands-on support and advice, we call that “value-add investors”. As a venture – start-up or scaleup, you aim to build and grow quickly and sustainably. While venture capital firms have a core incentive to provide a return on investment, founders of companies usually have other goals in mind, too – especially impact founders.

A positive convergence occurs where investor and founder goals are aligned and mutual trust and understanding drive decision-making. Naturally, investment relationships diverge if goals are misaligned, incentives are wrongly structured, or there’s a lack of understanding. The best example is investment funds operated by analysts who never launched and ran their ventures – how can they understand the daily struggles of a founder?

EBN: From your background in systems innovation, what learning do you take from this clash?

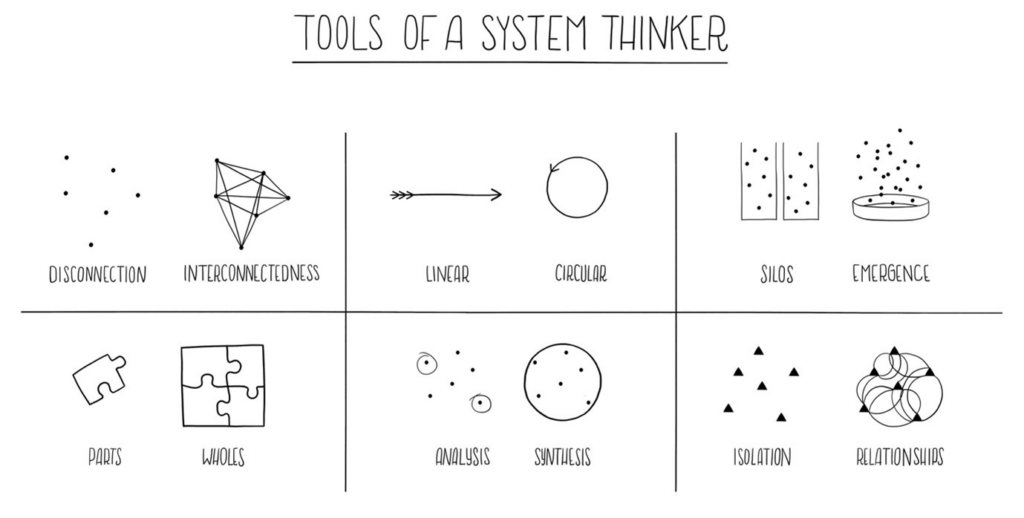

Tobias: Let’s start with defining a system in the first place: A system is a set of elements or parts that is coherently organised and inter-connected in a pattern or structure that produces a characteristic set of behaviors, often classified as its “function” or “purpose.”

Systems innovation is the application of systems thinking to change from one system stage into the next. For example, a misaligned, mal-functioning investment relationship can be adjusted by applying systems innovation, i.e. by changing communications, goals, autonomy between involved parties, or overall paradigms of the relationship. Systems innovations also helps founders or venture builders to understand their product market fit in a better, more resilient way: Once applied, systems thinking brings out product features for products vastly outpacing competitors – as they do not only change short-term usage, but long-term customer and systems behaviour.

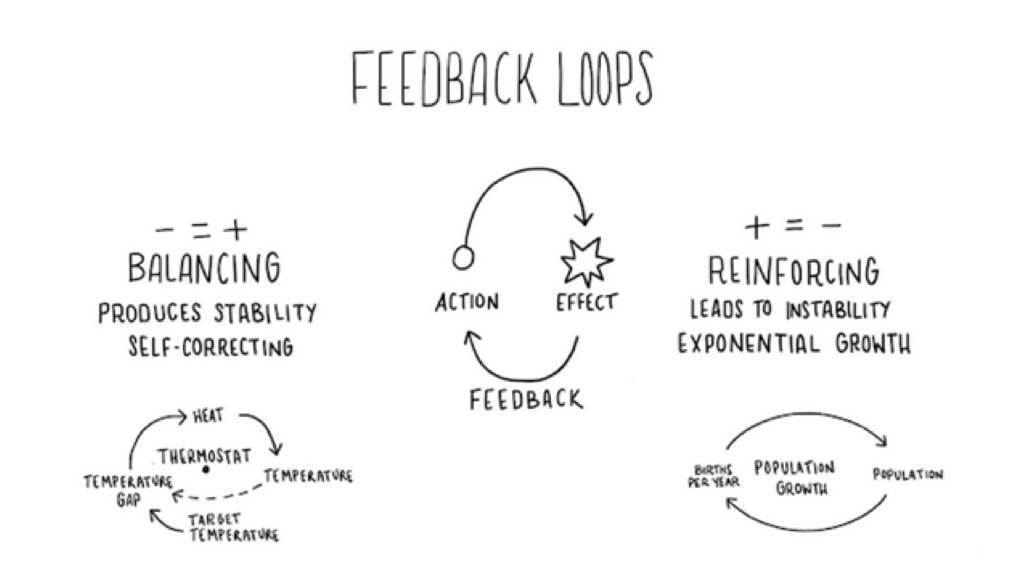

Feedback loops between investor, founder and

customer are crucial to observe for better venture

building performance.

EBN: As an example, how would this translate in better investing practices? How could impact investing make sense for sustainability?

Tobias: Systems innovation unfolds its potential in financing impact: When you build a new service or product to change the world for good, you want to be successful. However, meeting ESG requirements (Environmental, Social, Governance) from a founder’s perspective or complying with frameworks like SFDR is insufficient from a systems innovation perspective. Traditionally, these guidelines require founders and investors to meet isolated KPIs but do not provide incentives to formulate a solid change mechanism. Instead, better investing practices emerge if investors and founders begin exploring systems dynamics within their chosen field of business – for example, if they identify the underlying patterns of customer behaviour and economic as well as the ecological footprint of their offered services and products. When these insights embed into a clear impact investment framework, systems effects will be measured and appropriately managed.

EBN: For the readers working in incubators and accelerators, with innovators and entrepreneurs and their financiers on a daily basis, what are your key takeaways?

Tobias: Well, the key takeaways for us change makers and facilitators, working in business and innovation support organisations across Europe, is that impact if done correctly – requires a solid understanding of systems change and complexity management. We need to learn – and share – more about the complex systems around us. From food to urban mobility to packaging: We are surrounded by complex systems, where simple solutions usually provide more harm than good when applied. For our members, we need to be experienced in moderating their efforts in the right direction, matching them with suitable, well-organised investors and customers, and supporting their venture-building journey.

Also, we need to be connected to our members’ ecosystems, so we can provide access to stakeholders. I am certain systems innovation will play a crucial role for the next wave of venture funds and start-ups.